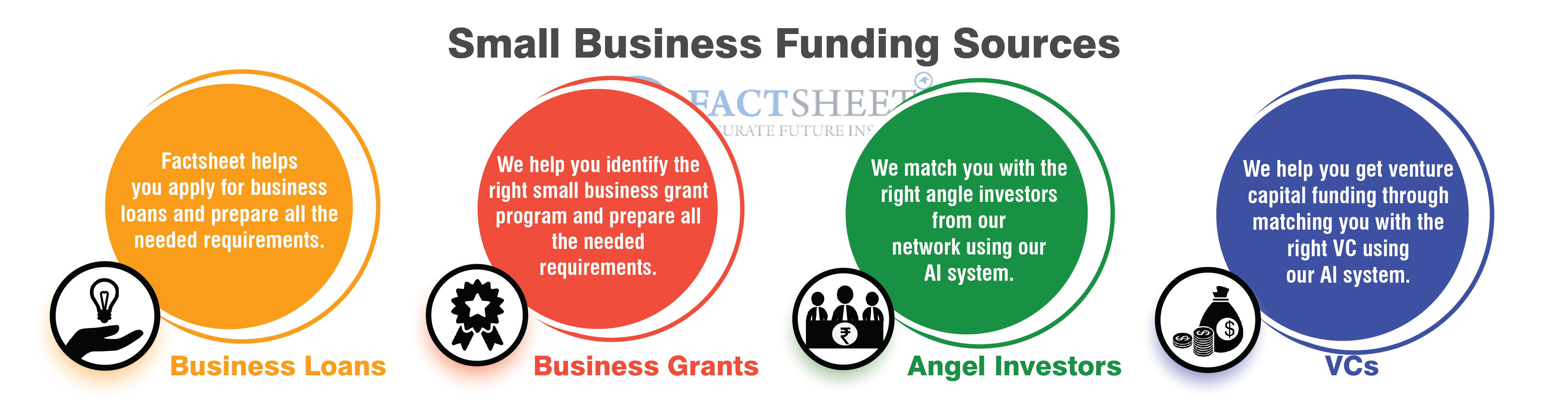

A. SMALL BUSINESS FUNDING

We assist small enterprises and start-ups in obtaining the capital they require. We work with you from the beginning and offer you with all of the assistance and resources you require. On a worldwide scale and in all industries, we collaborate with start-ups and investors. We assist small businesses in obtaining finance from a variety of sources, including business loans, start-up grants, angel capital, and venture capital.

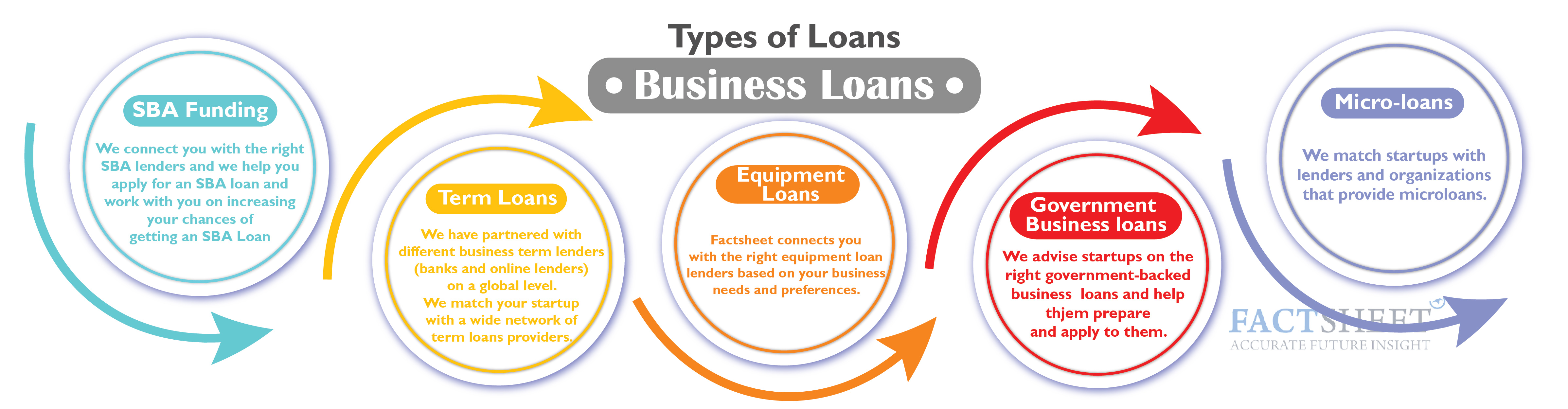

D. START-UP BUSINESS LOANS

We assist you in obtaining several sorts of business loans to fuel your start-up or small business. We link you with the correct bank or lenders that offer small business loans and compare many banks and lenders to get the best one. We also assist you both before and after the application procedure. We examine your business, credit score, and personal guarantee to ensure that it meets the lender's standards. We also help you prepare the documentation required for your application.

We assist you in obtaining several sorts of business loans to fuel your start-up or small business. We link you with the correct bank or lenders that offer small business loans and compare many banks and lenders to get the best one. We also assist you both before and after the application procedure. We examine your business, credit score, and personal guarantee to ensure that it meets the lender's standards. We also help you prepare the documentation required for your application.

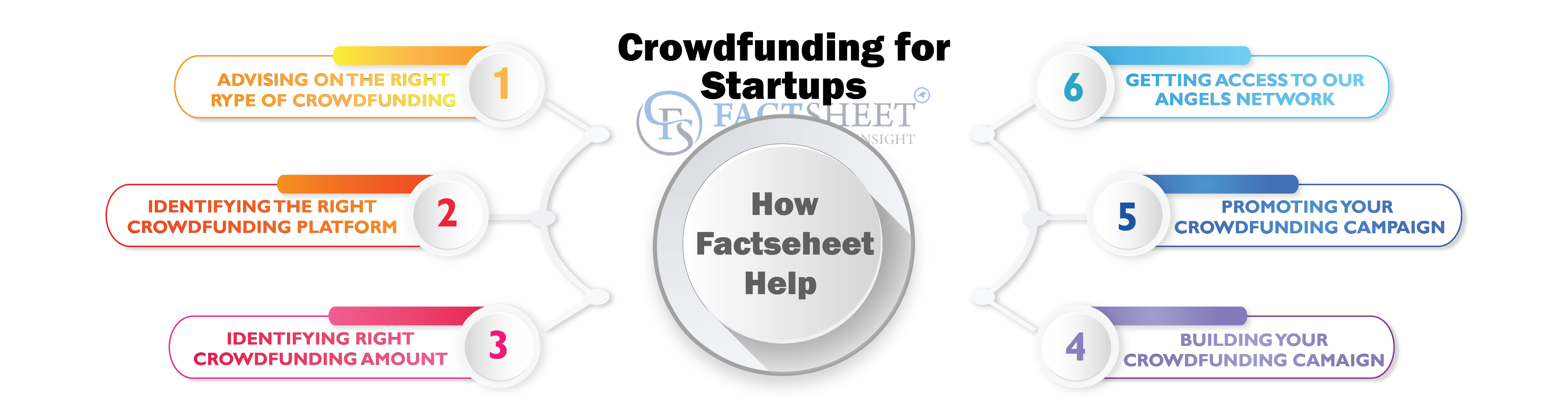

F. CROWDFUNDING FOR START-UPS

We assist you in planning a crowdfunding campaign and introduce you to the appropriate platform to fulfil your company objectives. We help with you to choose the best form of crowdfunding for your business. You will also get access to our extensive network of angels and venture capitalists and will be able to present your startup to those who are interested, increasing your chances of acquiring financing. We can also advise you on how to best market your campaign and raise brand recognition.

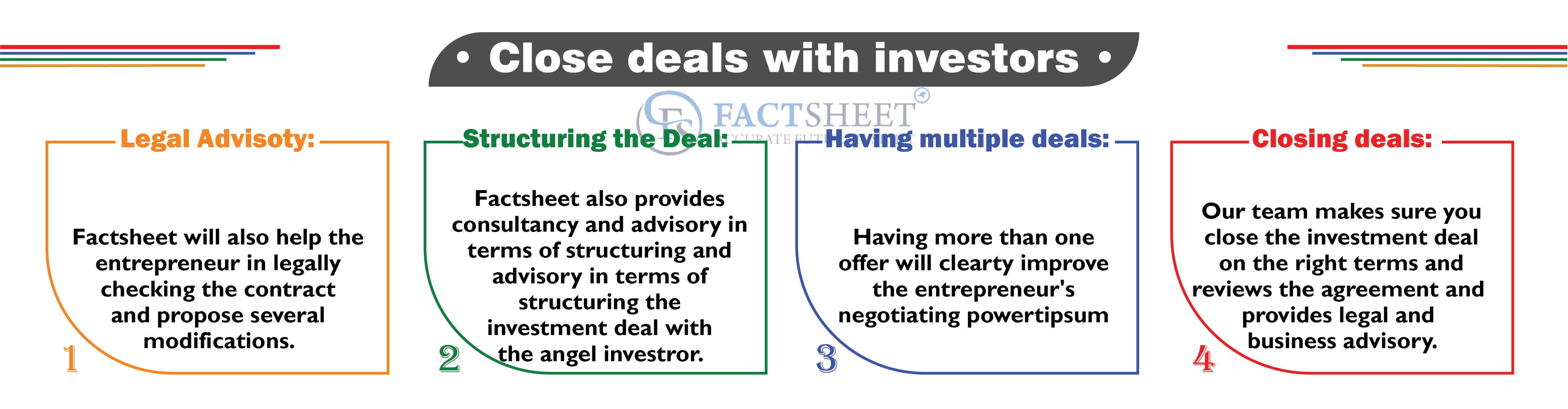

G. NEGOTIATIONS WITH ANGEL INVESTORS

We assist you in negotiating the fundraising agreement with angel investors, structuring the agreement, and concluding the funding agreement. We offer legal advice on how to negotiate with angel investors and what terms you should negotiate in order to effectively seal the agreement. We use different tactics depending on the stage of the startup and whether or not they have previously engaged in discussions with angel investors.

If the start-up is new to the negotiation phase and investment process in general, we would discuss with the team and help them review and improve on their material plus we explain about the term sheet and the most important terms and clauses they should focus on during the negotiations, such as liquidation preference, voting rights, dilution and board composition in order not to be surprised and be prepared and familiar with the term sheet language and clauses.

Essentially, we provide negotiating education since we recognize that entrepreneurs are not like angel investors and may lack the necessary legal knowledge and skills. We also assist entrepreneurs in determining the appropriate value for their start-ups and the amount of cash they need to seek from angel investors in order to effectively negotiate the term sheet and seal the deal on the best terms for both sides.